The Distribution of Federal Income Tax Payments in the United States

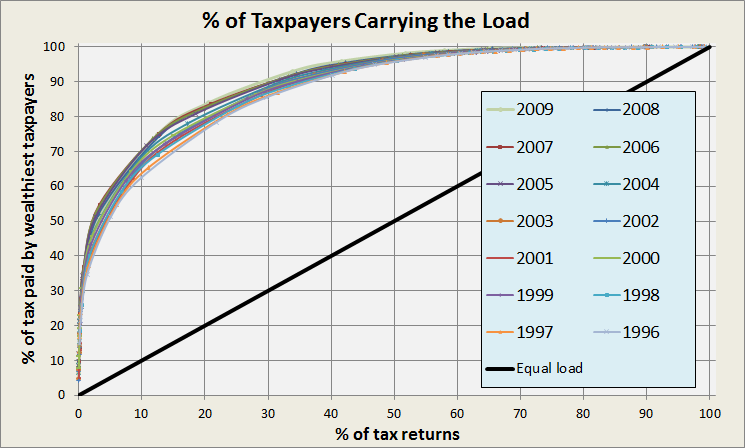

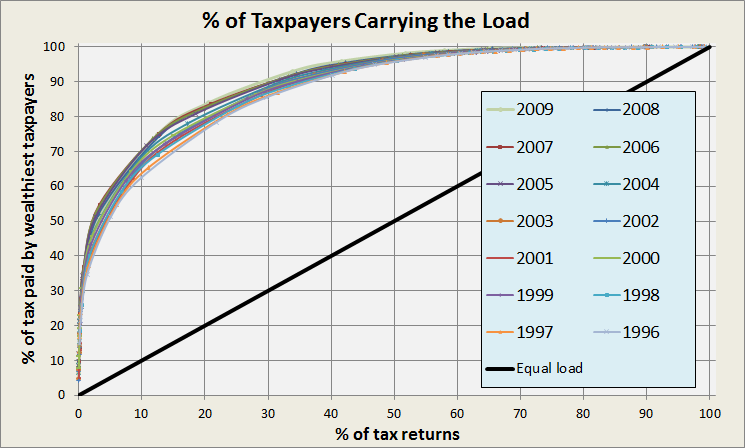

How often have we heard that the rich aren't paying their fair share of taxes, and that tax policy benefits the wealthy to the detriment of the middle class? While I'm not opposed to increasing taxes on the wealthiest Americans as part of a compromise that also includes serious spending cuts, before changing tax rates we should at least know what the current tax distribution is, and have an idea what the impact of any changes will be on tax revenue and unemployment. In terms of fairness, how many people know that the wealthiest 10% among us already pay over 60% of the federal income tax collected? This is good because it lessens the tax burden on the rest of us. The first graph shows the fraction of tax paid by the wealthiest taxpayers from 1996 through 2009 based on IRS data at http://www.irs.gov/uac/SOI-Tax-Stats---Individual-Statistical-Tables-by-Size-of-Adjusted-Gross-Income. The black line shows what the distribution would be if everyone contributed equally. The second chart zooms in on those 15% of taxpayers having the highest adjusted gross income, and it's clear the wealthiest citizens already pay a large fraction of total taxes paid. The top 5% pay over 50% of the total, and the wealthiest 1% pay over a third of the Federal income tax. The Occupy Wall Street crowd should be thankful for this contribution, and we should all consider what happens when "The 1%" takes more of their money out of the game. One reason for the sluggish recovery is that we're already seeing many with wealth sit on the sidelines and others invest their money overeseas instead of here in the United States. This is why tax policy should be important to anyone who cares about the unemployment rate in our country.

We've been told the rich have been paying less tax due to preferential treatment by the Republican Congress, yet the data magnified below shows a trend where the rich are actually paying an even higher percentage of the total tax burden in recent years than they used to. The lines for 1996-1997 during the Clinton Boom Years are the lower lines graphed below, while the upper curves are more recent where the wealthiest are paying an even higher percentage of the total tax burden than they used to. The economy was far healthier during the Clinton Boom Years than it has been during the Obama Recovery.

It's true that the wealthy can afford to pay even more tax than the graphs above show. And I suppose it's human nature to feel envy toward those who are well off. There are obviously many more of us than them, so we can easily impose higher marginal tax rates on them, yet we should be aware of the impact of higher taxes on employment, since many of the wealthiest taxpayers are small business owners who are responsible for hiring and firing, which depends on their balance sheets. The brilliant economist Thomas Sowell (along with many other economists) has pointed out that higher tax rates often DO NOT lead to higher tax revenues (note added 27.November.2012: a more current comment from Sowell regarding Stephen Moore's excellent book "Who's The Fairest of Them All" is available here). A good source of data explaining this is available from the Tax Foundation, although the short parable below the graphs also illustrates the simple fact that if the wealthy take their money out of the economy (or move it overseas), the rest of us have a higher burden (and greater debt to be passed on to our children). In the story, for all eleven people the road to Greece was paved with good intentions, but it did not lead to a good outcome since most of them were consuming more than they could collectively afford after what Occupy Wall Street derisively called "The 1%" left the table. The wealthy have many choices for how/where to invest their money and if we (the 99%) are smart, we'll be aware of that as we judge "fairness" and set policy.

That said, logic doesn't count for much these days and fiscal conservatives might be wise to allow the liberals to increase taxes on the wealthy in order to take the class warfare issue off the table since the Democrats in Congress and the President have used it to obscure the real issue that needs to be addressed, which is our runaway spending.

Here's a story illustrating the tax fairness issue that's worth a quick read

How Taxes Work-

Let's put tax cuts in terms everyone can understand. Suppose that every week, ten friends go out for dinner. The bill for all ten comes to $100. If each were responsible for his/her share of the bill, that would be $10 each. Instead they decided to divide the bill based upon their ability to pay, using the way we pay our income taxes as a guide, so this is how it went:

The first four — the poorest — would pay nothing; the fifth would pay $1, the sixth would pay $3, the seventh $7, the eighth $12, the ninth $18, and the tenth person — the richest — would pay $59. Seems more than fair, right?

So that's what they decided to do. The ten folks ate dinner in the restaurant every week and seemed quite happy with the arrangement — until one week, the owner threw them a curve (in tax language a tax cut).

"Since you are all such good customers," he said, "I'm going to reduce the cost of your meal by $20." So now dinner for the ten only cost $80.

The group still wanted to pay their bill the way we pay our taxes. So the first four were unaffected. They would still eat for free (can we agree for them to expect more than that would be rather audacious).. But what about the other six — the paying customers? How could they divvy up the $20 windfall so that everyone would get their "fair share?"

These six realized that $20 divided by six is $3.33. But if they subtracted that from everybody's share, the fifth person and sixth person would end up being PAID to eat their meal. So the restaurant owner suggested that it would be fair to reduce each person's bill by a "reasonable" amount, and he proceeded to work out the amounts each should pay.

And so the fifth person now paid nothing, the sixth pitched in $2, the seventh paid $5, the eighth paid $9, the ninth paid $12, leaving the tenth guy with a bill of $52 instead of his earlier $59. Each of the six was better off than before. And the first four continued to eat for free.

But once outside the restaurant, they began to compare their savings. "I only got one dollar out of the $20," declared the sixth person who pointed to the tenth. "But he got $7!"

"Yeah, that's right," exclaimed the fifth person, "I only saved a dollar, too . . . It's unfair that he got seven times more than me!".

"That's true!" shouted the seventh person, "why should he get $7 back when I got only $2? The wealthy get all the breaks!"

"Wait a minute," yelled the first four folks in unison, "We didn't get anything at all. The system exploits the poor!"

The nine people surrounded the tenth and voted him off the island (some say he left to go overseas). The next week he didn't show up for dinner, so the nine sat down and ate without him. But when it came time to pay the bill, they discovered, a little late, something they should have thought of before they drove him away. They were FORTY-TWO DOLLARS short of paying the bill! Imagine that!

And that's how the tax system works. The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up at the table anymore.

Some of us have jobs where we see first hand the effects of tax policy, specifically jobs being moved overseas where tax rates are lower. Since one thing ALL of us want is more and better jobs, let's think about the impact tax policy has on job creation by small business and large business alike. If we put our heads together, there's gotta be a way to increase revenues selectively WITHOUT creating disincentives to business seeking to grow.

It's fair to discuss how progressive our tax structure should be, but how many of us know how progressive it already is and who's carrying the load? Furthermore, how many appreciate that it's not just a question of how to split up the pie (i.e., what is fair), but also how big is the pie we split up? Let's not do things today that will cause the pie to shrink tomorrow by making it harder for business to operate in our country. The easiest way to be fair to all is to have a growing economy.

Page created 19.Aug.2012 and last modified 27.Nov 2012